Facebook is a social networking site and an online advertisement (ad-supported) company. Facebook is in a competitive position as the market leader. Products under Facebook have covered most of the social applications, including such platforms as Instagram, WhatsApp, and Messenger. “More than 2 billion people around the world to share ideas, and 100 billion-plus messages shared every day by Facebook” (Facebook, 2019, para. 1).

(Facebook, 2019)

1. Complete product chains

Facebook has determined precise positions for products under it, which can well avoid the emergence of homogenous competition within the company. For instance, Instagram focuses on photo-social interaction, while WhatsApp is purely a communication tool and prioritises the purpose of user chat with a simpler design interface. Meanwhile, WhatsApp Business is also provided for working contact among users. Messenger focuses more on communication among Facebook friends by languages. Targeting different friends, users can use different social networking apps. A more apparent distinction between work and life can protect user privacy to a certain extent. Every product has its clear target customers.

2. Stable sources of advertisements revenue

Through the content uploaded by users, Facebook can browse user records and friend lists to determine their user preferences, thereby sending them individualised advertisements. Companies can precisely deliver their paid advertisements to target customers, thus making it possible to reduce the cost of publicity focused on non-target users. Meanwhile, Facebook possesses complete data methods to test advertisement data, guaranteeing that the advertisement’s influence on user experience can be controlled within a certain range.

Advertisement revenue has also created impressive financial data. A comparison can be drawn between Facebook and Google using profit. ‘The gross profit rate of Facebook in 2019 was as high as 81.94%, the net profit rate was 26.15%, and the rate of return on investment was 17.72%’ (SEC, 2019). ‘For Google, a similar ad-supported company, its gross profit rate in 2019 was 55.46%, the net profit rate was 21.28%, and the rate of return on investment was 17.78% (SEC, 2019). The profitability of Facebook is much better than ad-supported Google. Regarding operation risks, the quick ratio of Facebook is 4.4 (Facebook, 2019), while that of Google is 3.35 (SEC, 2019).’ Facebook has slightly higher short-term debt-paying capacity and lower operational risks than Google.

3. Sustained innovation business

Though Facebook is in excellent financial condition, it is still actively exploring new businesses. According to Facebook’s CEO Zuckerberg, as a social networking giant with so many product lines, Facebook must make comprehensive breakthroughs in multiple fields such as technology products and management models before adapting to the development direction of social networking in the future (Facebook, 2014, para. 2). In 2014, Facebook acquired Oculus VR (virtual reality), which is the leader in immersive virtual reality technology. Through the VR blindfold of Oculus, Facebook wishes to bring brand-new game experience to users so that they can create game roles in virtual scenes for social interaction and establish communities (Facebook, 2019, para. 1). Aside from VR blindfold, Facebook is also exploring a virtual helmet, hence further enhancing users’ sense of immersion (Facebook, 2019).

(Facebook, 2019)

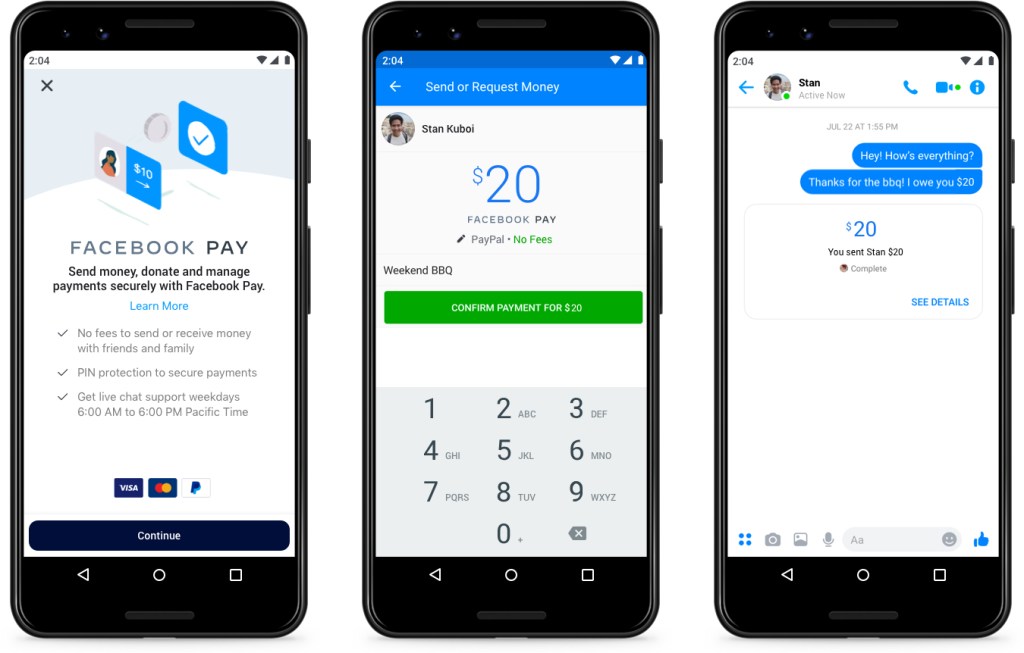

Aside from that, mobile payment has also become an area of innovation for Facebook Pay (EY, 2019, para. 2). Facebook has also declared a virtual cryptocurrency named Libra. Libra is a cryptocurrency that does not pursue the stability of the USD (United States dollar) exchange rate but is inclined toward relatively stable purchase power (Libra, 2019).

Is it sustained?

Though Facebook is a successful company, some problems still exist. In 2018, Facebook’s Cambridge Analytica data scandal emerged. In March 2018, The New York Times reported a data mining company named Cambridge Analytica. “It was provided for election through the profiles up to 87 million Facebook users” (Natasha, S, 2018. para. 1). Based on users’ personalities and preferences, political advertisements were more effectively delivered in a more targeted manner when users knew nothing about it (Kevin, G., 2018, para. 8). Facebook’s lack of supervision over data security or the laissez-faire attitude became powerful tools in political campaigns. This led to great repulsion from users, and consequently, Facebook experienced a privacy crisis and newsfeed integrity issues. Perhaps more complete privacy policies and regulations on data security should be formulated inside companies. Before news media dig out relevant information, the operation rules of companies should be clarified. We may need to prevent the reoccurrence of such incidents through the relevant legislation.

(Facebook, 2019)

Besides, short videos have also become a new way of communicating with users, such as TikTok. From a social interaction perspective, exchanges through short videos may not affect the status of traditional social networking apps. For most users, they still identify with friends in real-life contact and interaction to find their value. The content and people in short videos may be far away from the life of users. On short video platforms, users may watch a great variety of content and advertisements in a short period. This is conducive to commerce, and perhaps in the future, short video apps will become competitors of Facebook in advertisement businesses.

Though some defects exist in Facebook, it still possesses complete product chains. Meanwhile, its way of interaction can satisfy the emotional needs of most users. Aside from that, it has also actively expanded its VR businesses so that the products of the company can experience diversified development. This may be a sustainable operation and development model.

References:

EY. (2019). Will slow payment systems put the brakes on economic growth? Retrieved from 1 March, 2020https://www.ey.com/en_gl/banking-capital-markets/will-slow-payment-systems-put-the-brakes-on-economic-growth

Facebook. (2019). Charting a Way Forward on Online Content Regulation. Retrieved from 29 February, 2020https://about.fb.com/news/2020/02/online-content-regulation/

Facebook. (2019). Company info. Retrieved from 1 March, 2020:

Facebook. (2020). Facebook logo Brand Resource Center. Retrieved from 29 February, 2020 https://en.facebookbrand.com

Facebook. (2014). Facebook to Acquire Oculus. Retrieved from 29 February, 2020

Facebook. (2019). Simplifying Payments with Facebook Pay. Retrieved from 28 February, 2020

Kevin, G. (2018, March 19). Facebook and Cambridge Analytica: What You Need to Know as Fallout Widens. The New York Times. Retrieved from 1 March , 2020 https://www.nytimes.com/2018/03/19/technology/facebook-cambridge-analytica-explained.html?searchResultPosition=19

KPMG. (2020). Banking on consumer platforms. Retrieved from 29 February, 2020

https://home.kpmg/xx/en/home/insights/2020/01/banking-on-consumer-platforms.html

Libra. (2020). Welcome to Libra. Retrieved from 29 February, 2020

https://libra.org/en-US/?noredirect=1

Matthew, R. (2019, March 15). Academic Behind Cambridge Analytica Data Mining Sues Facebook for Defamation. The New York Times. Retrieved from 29 February, 2020

Natasha, S. (2018, April 11). What You Don’t Know About How Facebook Uses Your

Data. The New York Times. Retrieved from 29 February, 2020 https://www.nytimes.com/2018/04/11/technology/facebook-privacy-hearings.html?searchResultPosition=4

SEC. (2019). Alphabet Inc. (Filer) CIK: 0001652044

Retrieved from 1 March , 2020

SEC. (2019) Facebook Inc (Filer) CIK: 0001326801. Retrieved from 1 March, 2020